In an effort to offset an estimated $450 billion annual loss due to tax evasion, the IRS Whistleblower Office awards money to whistleblowers who report tax fraud. However, the process from filing a claim to being awarded has many steps and may take several years.

While the process can vary, depending on the individual circumstances of the claim, here is some general information about the steps to filing a whistleblower claim:

Filing a Claim

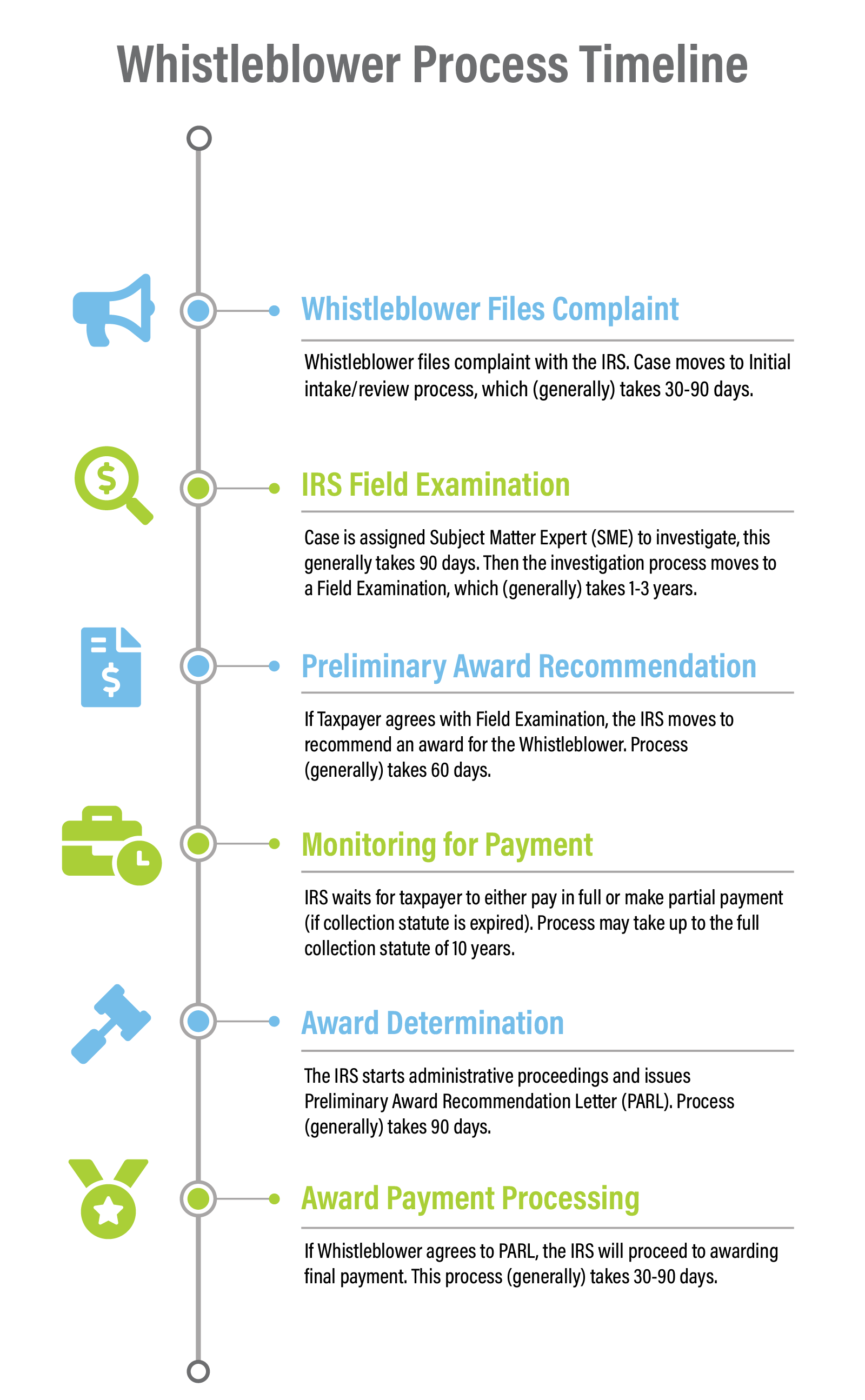

The process starts with the whistleblower filing Form 211, Application for Award for Original Information with the Whistleblower Office at the IRS. Once received, the claim moves to the “intake/initial review” process, which generally takes 30-60 days.

If the claim is rejected, the IRS will issue a “rejection or denial letter” to the whistleblower explaining why the claim was rejected. If the whistleblower’s claim was rejected, that doesn’t mean the process is over. There are still several options, per the IRS:

Claims rejected or denied as a § 7623(b) claim have an administrative proceeding and are eligible to be petitioned to the tax court.

So, for example, if the claim is rejected because the claim was missing information and/or is incomplete, the whistleblower has the option to bring their claim to the tax court for a second review.

Common Initial Review Rejection/Denial Reasons:

- No specific or credible tax issue,

- Claim is missing information,

- Claim is purely speculative,

- Insufficient Assessment Statute, or

- Assessment Statute Expired

However, if the claim is given the green light to proceed, the IRS will assign a Subject Matter Expert (SME) who reviews the submission. This SME review generally takes 90 days.

Field Examination

From there, the case moves to the Field Examination, which can generally take 1-3 years. While that can seem like a long time, this gives the IRS extra time to examine the case. Once the exam is complete, the IRS will contact the taxpayer with their findings.

From this step, the whistleblower has two possible outcomes: if the taxpayer agrees with exam, the case moves to a Preliminary Award Recommendation (generally this step takes 60 days). If the taxpayer does not agree with the exam, the case moves to Appeals/Tax Court, which generally could take 3-10 years.

If the Tax Court rules in the taxpayer’s favor, the claim gets rejected and the whistleblower is issued the Rejection or Denial letter. If the Tax Court rules in favor of the whistleblower’s claim, the case moves on to the Preliminary Award Recommendation step.

Monitoring for Payment

At this point in the process, the IRS has determined the whistleblower’s claim is valid, and either the taxpayer has agreed to the field exam or the Tax Court has ruled that “all or some adjustments [were] upheld.” Now, the IRS has to wait for the taxpayer to comply and pay the taxes owed. According to the IRS, this step in the process “may take up to the full collection statute of 10 years.”

Once the taxpayer has complied by either paying the owed amount in full or made a partial payment (if the collection statute has expired), the case moves to the Award Determination process, which generally takes 90 days.

Preliminary Award Recommendation Letter (PARL)

Once the claim has completed the Award Determination process, the IRS “starts the administrative proceeding” and issues a Preliminary Award Recommendation Letter (PARL) to the whistleblower. During this process, the IRS will monitor the “Refund Statute Expiration”, which is generally 2 years from the date of payment.

If the whistleblower agrees to PARL, the case moves on to Award Payment Processing, which generally takes 30-90 days. But, if the whistleblower does not agree to PARL or doesn’t respond, the IRS will issue a Final Determination, which generally takes 30-60 days.

However, if the whistleblower does not agree with the PARL, they can petition the Tax Court, which could delay the process (generally) 3-6 years. If they choose to not petition Tax Court, the case moves to the Award Payment Processing step, as outlined above.

Overall, the process has multiple steps, and again, depending on the nature of the individual whistleblower claim, isn’t always a straight line from reporting the taxpayer to receiving a monetary award. While we can’t outline all the steps for each whistleblower claim, the process explained here is merely meant as a guideline of what the whistleblower may expect if they choose to report.

As a general rule of thumb, it’s always best to consult with a tax professional before filing a claim so that they can discuss the different options and help protect the whistleblower’s legal rights.

Additional Resources:

IRS Whistleblower Office At a Glance

IRS: How Do You Report Suspected Tax Fraud Activity?

Publication 5251: The Whistleblower Claim Process and Timeline